Let’s do this! A bold move means a higher risk and potentially higher returns.

Your investment volatility (that means by how much your investment is fluctuating/variating) is capped at a maximum of 20%.

Forward Quant is a unique new approach to long-term investing that balances security and performance through flexible guarantees at a fixed fee for the duration of the contract. Powered by market-leading quant technology, Forward Quant automatically diversifies the investment across geographies and asset classes.

When it comes to investing, one particular approach is definitely not suitable for everyone. Therefore, we start with a sophisticated questionnaire to analyze your “risk appetite” based on your unique personality and life goals. This way, we identify your “risk type” ranging from “conservative” to "explorative". And as your circumstances can change over time, we give you the possibility to also change your risk type.

What is my risk type? What is a capital guarantee? If you’ve never asked yourself these questions, don’t worry! We’ve got your back. Here is a simple way for us to give you some answers.

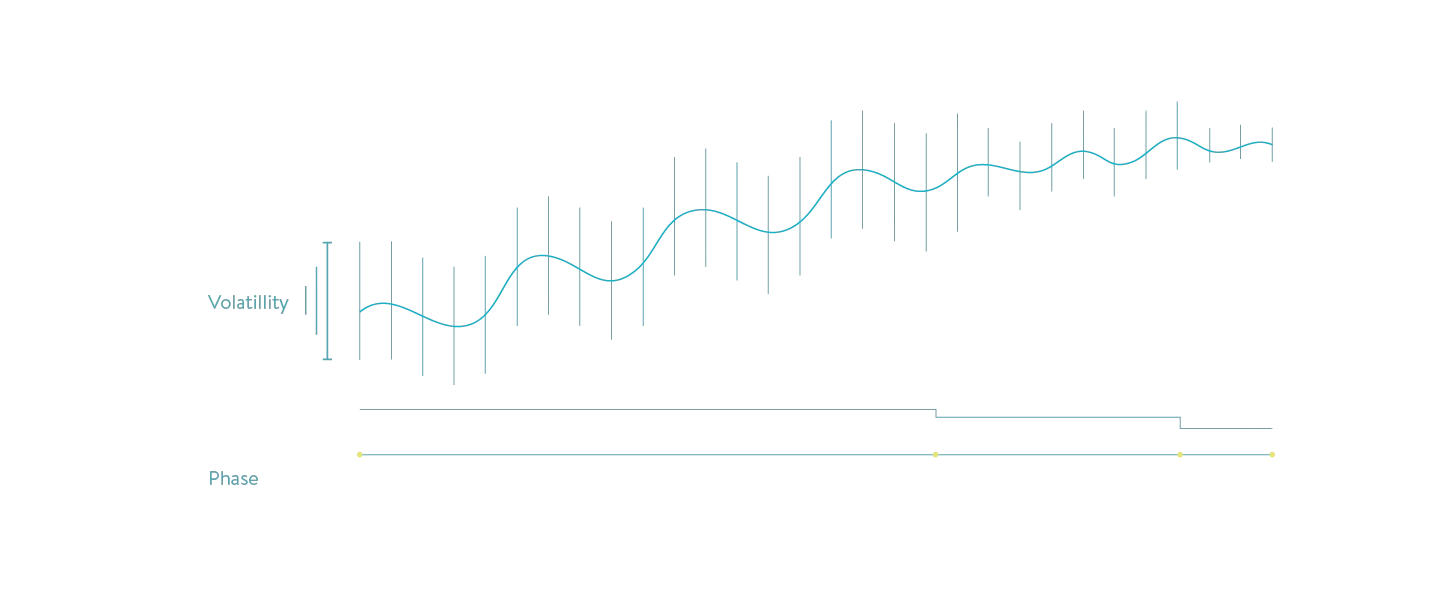

While every investor is unique, there are two things we have in common: we all want to make sure our level of risk is controlled and we all want the best possible returns. That’s why, we’ve built into Forward Quant a smart approach to risk. Your investment passes through three distinct phases over time, enabling higher returns at first, and more security later on.

Forward Quant’s three-phase game plan

Forward Quant kicks things off with a dynamic approach to risk, so, you can exploit all the market opportunities in the early period of your investment. Then, it automatically switches to a balanced middle phase. Finally, the level of risk is reduced even further towards the end of your investment to consolidate your gains and secure your return:

Let’s do this! A bold move means a higher risk and potentially higher returns.

Your investment volatility (that means by how much your investment is fluctuating/variating) is capped at a maximum of 20%.

Let’s do this! A bold move means a higher risk and potentially higher returns.

Your investment volatility (that means by how much your investment is fluctuating/variating) is capped at a maximum of 20%.

Bring it home! Reducing risk to a minimum in the final 3 years means you finish safe and sound.

Your investment volatility is capped at a maximum of 6.5%.

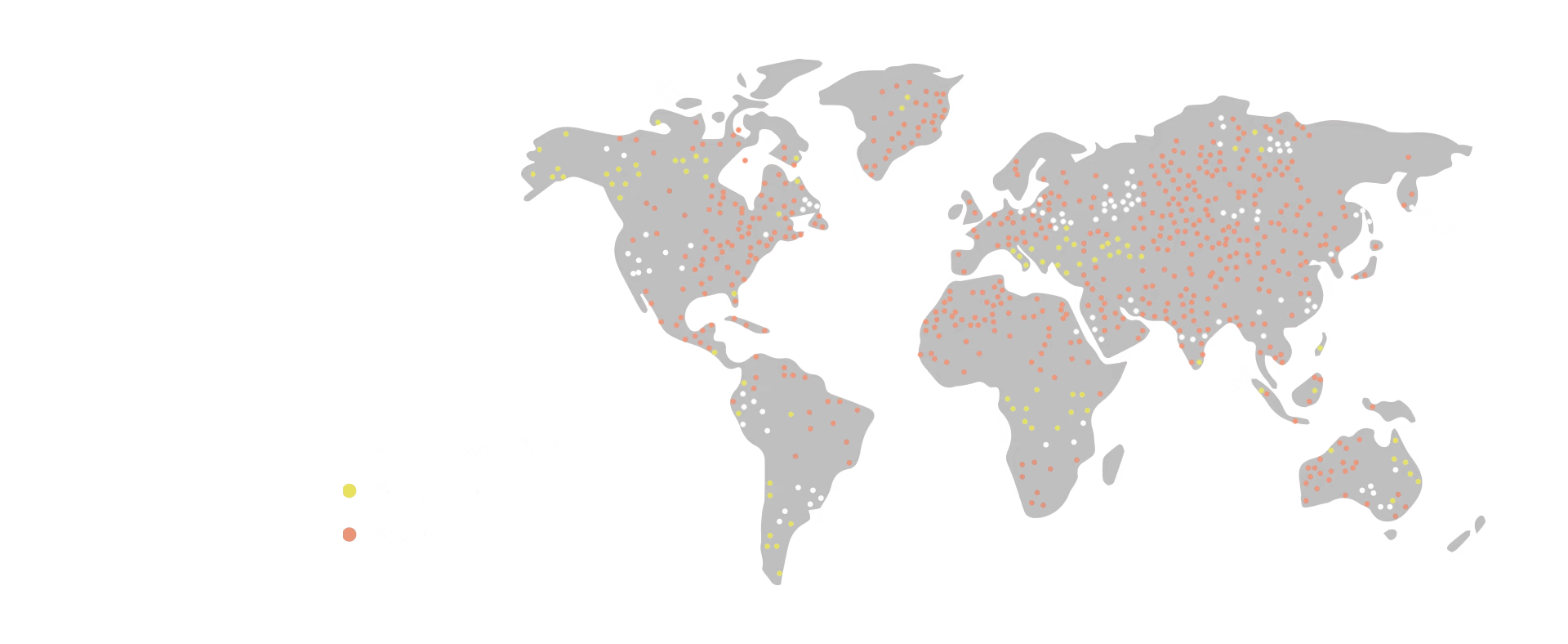

The key to a long-term investment strategy is diversification across the broad investment universe. With Forward Quant, your investment is spread across assets from all around the world, so, you don’t have to worry about the ups and downs of regional financial markets. Equities, fixed income bonds, money market instruments, real estate - we give you an access to all of them. It’s a worldwide approach implemented in Luxembourg and Vienna: leading centers of financial innovation and highly regulated investments.

Diversification? Sounds good, but what exactly does it mean?

Over 400,000 global assets

across the investment universe.

1,000 times more assets

on average in the market compared to a similar product.

Unlimited sets of investments

across asset classes and markets.

It was important for me to work with experts with regards to saving and investing my money. With FWU investment products, I had the feeling that my money is safe and secure right from the beginning - I can therefore wholeheartedly recommend FWU’s products and expertise.

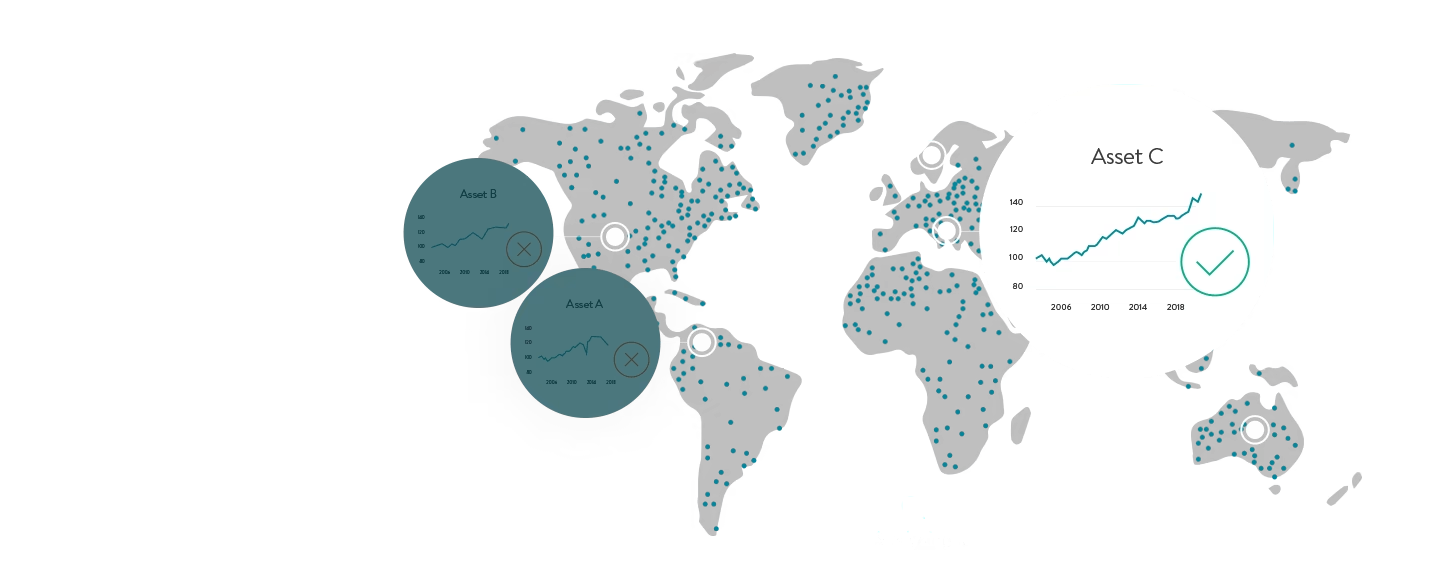

Numbers beat instinct, so, it’s time to bring technology on your side. With Forward Quant, investment decisions are calculated by a state-of-the-art constantly evolving algorithm. This intelligent use of data allows decisions to be made based on analysis rather than emotion. It has nothing to do with acting instinctively; it's a sophisticated approach that makes your money roll forward.

So, what exactly does this smart algorithm do?

Performs deep analysis

that continuously evaluates complex financial data.

Calculates the best decisions

for your current risk type.

Filters emotions

out of investment decisions.

Balances between

security and opportunity.